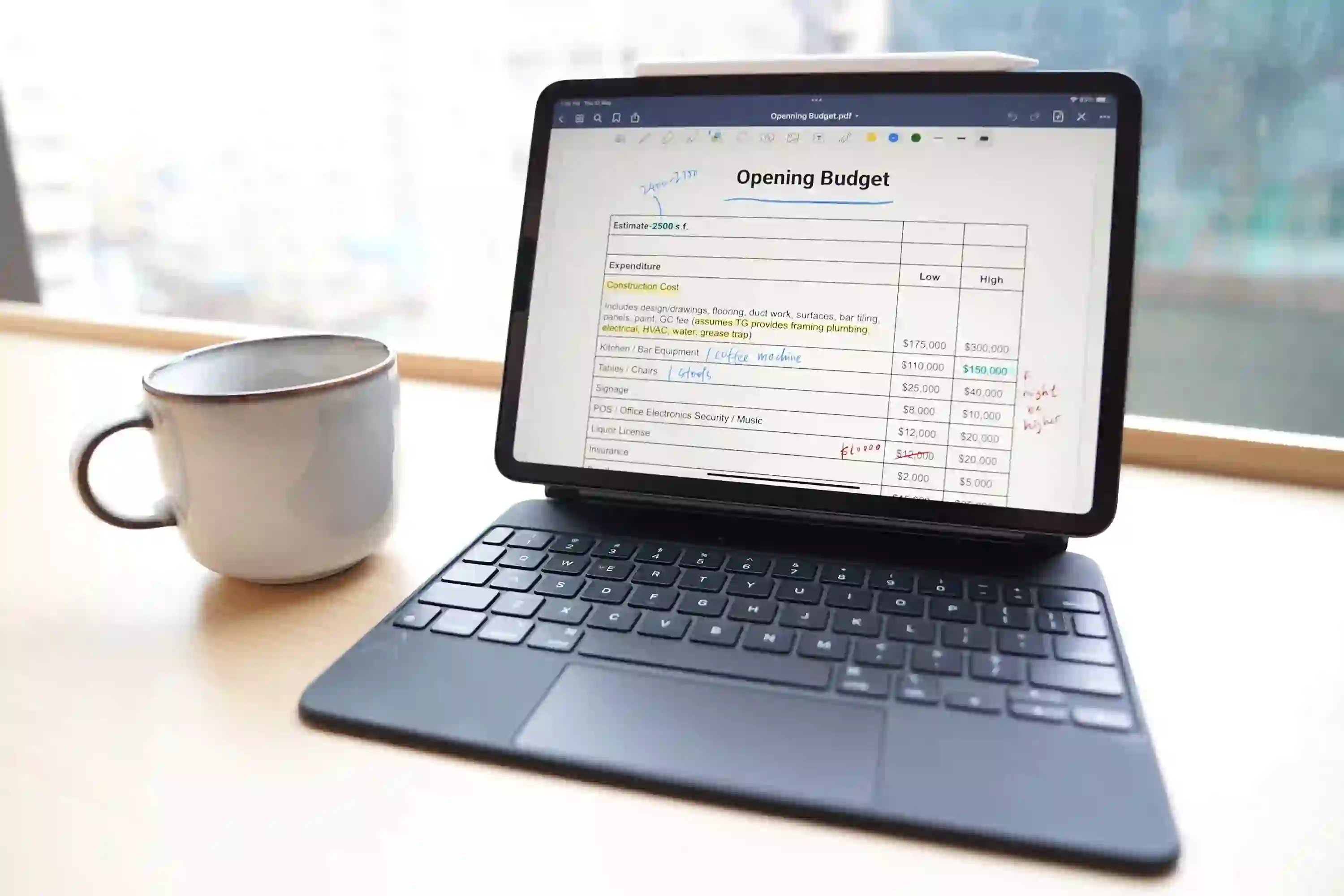

Zero Based Budgeting Example

Zero-based budgeting is a method of budgeting in which all expenses must be justified for each new period. This approach contrasts with traditional budgeting, in which a budget is based on the previous period’s actual results, with adjustments for expected changes. The process of zero-based budgeting starts with a “blank slate” and all expenses must be justified for each new period. This means that every expense, whether it is a fixed cost or a variable cost, must be evaluated and justified....