TLDR

New budget every month, every dollar has a destination

Stay out of consumer debt

Reasonable mortgage or rent (< 25% of your take home pay)

Pay off any consumer debt

Put 15% in your income into retirement account (invest in index mutual fund)

Have a 6 month emergency fund

Pay off credit card balance when you receive the statement

Stay away from cash value/whole life/univeral life insurance

Only buy used cars

Introduction

Hey there! Have you ever found yourself lost in the maze of financial decisions? I know I have. That’s why I want to talk to you today about financial planning - a process that can help you take control of your finances and achieve your goals, whether you’re trying to save up for a dream vacation or plan for retirement.

The financial planning process can seem daunting at first, but trust me, it’s worth it. By analyzing your current financial situation, setting goals and objectives, developing a financial plan, and implementing and monitoring it, you can gain financial security and peace of mind.

Believe me, I learned this the hard way. I used to spend money like there was no tomorrow, never thinking about the consequences of my actions. But after a few financial setbacks, I realized that I needed to take control of my finances if I wanted to achieve my goals.

That’s why I want to encourage you to embark on this financial planning journey with me. It may seem challenging at first, but it’s worth it in the end. So, let’s dive in and discover how financial planning can help us achieve our dreams and build a brighter future!

Setting Goals and Objectives

Defining short-term and long-term goals

Defining short-term and long-term goals is super important when it comes to financial planning! Short-term goals are things we want to achieve within the next few months or year. It could be something as simple as buying a new outfit or treating ourselves to a fancy dinner. Long-term goals, on the other hand, are much bigger and take longer to achieve. These could be things like saving up for a down payment on a house or planning for retirement.

To be honest, I used to think that I didn’t need to set goals - I was just happy living in the moment. But then I realized that having goals gave me something to work towards, and it felt amazing when I finally achieved them!

So let’s take a moment to think about what our short-term and long-term goals are. They don’t have to be perfect or set in stone, but having them in mind can help us make better decisions with our money. Remember, whether your goals are big or small, they’re all worth pursuing!

Identifying objectives to achieve goals

Identifying objectives is the next step in achieving our financial goals. Objectives are specific actions that we can take to reach our goals. For example, if our short-term goal is to save up for a vacation, our objectives might be to cut back on eating out, find ways to earn extra money, and create a budget to track our spending.

Honestly, I used to get overwhelmed when it came to identifying objectives. It seemed like there were so many things I needed to do to achieve my goals! But then I realized that breaking down my goals into smaller, achievable objectives made it easier to take action. Plus, it felt so satisfying to cross off objectives as I completed them!

So let’s take some time to think about what objectives we need to achieve our goals. Remember, they don’t have to be perfect or set in stone - we can always adjust them as we go. The important thing is to take action and move forward towards our financial dreams!

Prioritizing goals and objectives

Once we have defined our financial goals and identified the objectives to achieve them, the next step is to prioritize them. Prioritizing helps us focus on the most important goals and objectives, and ensures that we’re using our resources wisely.

To be honest, prioritizing used to be a struggle for me. I wanted to achieve everything all at once, but that’s just not realistic! So now, I take a step back and really think about what’s most important to me. Sometimes, I’ll even ask myself, “If I could only achieve one goal this year, what would it be?” This helps me narrow down my priorities and focus my energy on the things that matter most.

Once we have our priorities in order, we can start working towards our goals and objectives with a clear focus. Remember, it’s okay to adjust our priorities as we go - life is unpredictable and our goals may change. But as long as we keep moving forward towards our dreams, we’ll get there eventually!

Analyzing Financial Situation

Evaluating current financial situation

Evaluating our current financial situation is the first step in creating a solid financial plan. It involves taking a close look at our finances and understanding where we stand. This can be daunting, especially if we’ve been avoiding our finances for a while! But don’t worry - we’re all in this together.

To start, we need to gather all of our financial information in one place. This includes our bank statements, credit card bills, loan statements, and any other financial documents we may have. Then, we can start to make sense of it all. It’s helpful to look at our income, expenses, and debt to get a clear picture of our financial health.

I’ll be honest, when I first did this exercise, I was a little scared of what I would find. But it was actually really empowering to understand my financial situation and take control of my money. So let’s take a deep breath and get started - our financial future is counting on us!

Identifying assets and liabilities

Identifying our assets and liabilities is the next step in analyzing our financial situation. Assets are things that we own that have value, like our savings accounts, investments, and property. Liabilities, on the other hand, are things that we owe, like credit card debt, loans, and mortgages.

Honestly, I used to get confused between assets and liabilities all the time! But now I think of it like this - assets are things that bring money into our lives, while liabilities are things that take money out of our lives. This mindset shift has helped me identify which parts of my financial situation are working for me, and which parts need some work.

So let’s take a look at our assets and liabilities and see where we stand. It can be helpful to make a list of all our assets and their values, as well as all our liabilities and their balances. This will give us a clear picture of our net worth - the difference between our assets and liabilities. And remember, our net worth doesn’t define us as people - it’s simply a tool to help us understand our financial situation and make better decisions moving forward.

Reviewing income and expenses

The last step in analyzing our financial situation is reviewing our income and expenses. This is where we take a hard look at how much money we’re bringing in, and where it’s all going. Trust me, this can be a little overwhelming at first, but it’s an essential part of financial planning.

To start, we need to gather all of our income sources - our paychecks, side hustles, and any other money we’re making. Then, we can start to track our expenses. This means keeping a record of everything we’re spending money on - from bills and groceries to entertainment and shopping.

I’ll admit, when I first did this exercise, I was shocked at how much money I was spending on things that didn’t really matter to me. But it was also a wake-up call to start making some changes. Now, I track my expenses regularly and make sure I’m putting my money towards the things that really bring me joy and fulfillment.

Remember, the goal of reviewing our income and expenses isn’t to shame ourselves or feel guilty about our spending habits. It’s simply a way to understand our financial situation and make more informed decisions moving forward. So let’s take a deep breath and dive in - we’ve got this!

Developing a Financial Plan

Identifying strategies to achieve goals

Now that we’ve set our goals and analyzed our financial situation, it’s time to start developing a plan to achieve those goals. This is where we get to be a little creative and come up with strategies that work for us.

For example, if our goal is to save up for a down payment on a house, we might identify strategies like cutting back on dining out, taking on a side hustle, or negotiating a raise at work. Or, if our goal is to pay off credit card debt, we might look into strategies like consolidating our debt or transferring balances to a lower interest rate card.

There’s no one “right” way to achieve our goals - it’s all about finding what works for us and our unique situation. That might mean taking baby steps towards our goals or making big, bold moves. Whatever our strategies are, it’s important to stay flexible and open to making adjustments along the way.

Remember, achieving our goals is a journey, not a destination. It’s okay to make mistakes and take detours - what’s important is that we keep moving forward and stay committed to our plan. So let’s get creative and start identifying those strategies!

Developing a budget

One of the key components of any financial plan is creating a budget. I know, I know - the word “budget” can make us feel a little restricted and deprived. But really, a budget is just a tool to help us prioritize our spending and make sure we’re putting our money towards the things that matter most to us.

To create a budget, we need to start by looking at our income and expenses. We can use the information we gathered during the “reviewing income and expenses” step to get started. Then, we can start to allocate our money towards different categories - like housing, transportation, food, and entertainment.

It’s important to remember that a budget isn’t set in stone - we can always make adjustments as needed. And while it might feel a little overwhelming at first, sticking to a budget can actually be really empowering. It helps us take control of our finances and feel more confident in our ability to achieve our goals.

So let’s take a deep breath and get started on creating our budget. We might be surprised at how much more in control of our finances we feel!

Creating an investment plan

When it comes to achieving our long-term financial goals, like retirement, creating an investment plan is a crucial step. But I know - the world of investing can feel overwhelming and intimidating. The good news is, it doesn’t have to be!

To start creating our investment plan, we need to think about our risk tolerance and goals. Are we comfortable with taking on more risk for potentially higher returns, or do we prefer to play it safe with more conservative investments? And what are our long-term goals for our investments?

Once we have a sense of our risk tolerance and goals, we can start researching different investment options - like stocks, bonds, and mutual funds. We might also consider working with a financial advisor who can help us navigate the world of investing and create a plan that works for us.

Again, it’s important to remember that investing is a journey, not a destination. We might experience ups and downs along the way, but with a solid plan and a long-term mindset, we can feel confident in our ability to achieve our financial goals. So let’s get started on creating our investment plan - our future selves will thank us!

Managing debt

Debt is a part of life for many of us, and managing it can feel like a never-ending uphill battle. But fear not - there are steps we can take to get our debt under control and start making progress towards our financial goals.

First, we need to take a hard look at our current debt situation. How much do we owe, and to whom? What are the interest rates and payment terms? Once we have a clear picture of our debt, we can start to prioritize which debts to tackle first.

One common strategy for debt management is the “debt snowball” method. With this approach, we focus on paying off our smallest debts first, while still making minimum payments on our other debts. As we pay off each debt, we can roll that payment amount into the next smallest debt, creating a “snowball” effect that helps us pay off our debts faster.

Another important aspect of managing debt is to avoid taking on more debt whenever possible. This might mean creating a budget to help us live within our means, or finding ways to increase our income to help pay off debt more quickly.

Remember, managing debt is all about taking small, consistent steps towards our financial goals. It might not be easy, but with perseverance and a willingness to make some changes, we can start to feel more in control of our finances and on our way to a brighter financial future.

Implementing Financial Plan

Establishing a timeline

Establishing a timeline is a crucial part of implementing a financial plan. It’s important to set realistic deadlines for each of our financial goals, as well as to track our progress along the way.

When establishing a timeline, it’s important to be honest with ourselves about how much time and effort we can realistically commit to each goal. It’s better to set slightly longer deadlines that we can realistically achieve than to set overly optimistic ones that we’re unlikely to meet.

It can also be helpful to break down our goals into smaller, more manageable milestones. For example, if our goal is to save up a down payment for a house, we might break that down into monthly or quarterly savings targets.

Finally, it’s important to regularly review our timeline and make adjustments as needed. Life is unpredictable, and unexpected expenses or changes in income can throw off our plans. By staying flexible and making adjustments as needed, we can stay on track towards our financial goals.

Making necessary adjustments

Making necessary adjustments to our financial plan is an important step in achieving our financial goals. No matter how well we plan, life is unpredictable, and unexpected expenses or changes in income can occur. Therefore, it’s crucial to regularly assess our progress and make the necessary adjustments to keep ourselves on track.

One common mistake people make when implementing their financial plan is being too rigid. Setting unrealistic expectations or not accounting for unforeseen expenses can quickly derail our plans. We need to be open-minded and adaptable when making adjustments to our plan.

To make necessary adjustments, we should review our goals and priorities regularly. As our priorities and circumstances change, we may need to shift our goals to reflect our current situation. We should also evaluate our spending habits and identify areas where we can cut back or reallocate funds towards our goals.

It’s also important to establish a realistic timeline for achieving our goals. We should break down our long-term goals into smaller, achievable steps and regularly assess our progress towards these milestones.

In conclusion, implementing a financial plan is an ongoing process that requires flexibility and adaptability. By making the necessary adjustments to our plan, we can stay on track towards achieving our financial goals and improve our overall financial wellbeing.

Choosing appropriate financial products

After creating a financial plan, it’s important to choose appropriate financial products to achieve your goals. With so many different products available, it can be overwhelming to figure out which ones are best for you. It’s okay to make mistakes and learn as you go.

Maybe you’ve heard of a hot new stock that everyone is talking about and you’re tempted to invest all your money into it, but it’s important to do your research and make informed decisions. Don’t be afraid to ask for advice from a trusted financial advisor or do some research online.

Remember, the goal is to choose financial products that align with your goals and risk tolerance. Whether it’s a savings account, a mutual fund, or a certificate of deposit, make sure you understand the terms and fees associated with each product before making a decision. And don’t forget, you can always adjust your financial plan as your goals and financial situation change over time.

Monitoring and Reviewing Financial Plan

Reviewing progress towards goals

So, you’ve got a financial plan in place, congrats! Now comes the hard part - sticking to it. It’s important to review your progress towards your goals every once in a while. I mean, who hasn’t thought they were doing great with their diet until they realized they’ve been eating a bag of chips every day? Same goes for your finances.

To start, take a look at your goals. Did you want to save $500 a month for your emergency fund? How much have you saved so far? Did you want to pay off your credit card debt by the end of the year? Have you made any progress? It’s okay if you haven’t hit your goals yet, but it’s important to know where you stand.

Next, look at your spending habits. Have you been sticking to your budget? Or have you been splurging on things you don’t really need? Maybe you had a bad day and decided to treat yourself to a fancy dinner - we’ve all been there! But if you find yourself doing this often, it might be time to reevaluate your spending.

Finally, give yourself a pat on the back for what you have accomplished. Maybe you were able to save more than you thought you could, or you were able to negotiate a lower interest rate on your credit card. Celebrate those wins, no matter how small they may seem.

Revising plan as needed

As much as we’d like to stick to a financial plan and watch it come to fruition, life can be unpredictable. Unexpected expenses, changes in income, and shifting priorities can all affect your ability to reach your financial goals. That’s why it’s important to be open to revising your financial plan as needed.

The first step is to identify what’s not working. Perhaps you set a goal to pay off your credit card debt in six months, but unexpected expenses have made it difficult to stick to that plan. Or maybe you underestimated how much you’d need to save for a down payment on a house. Whatever the issue, it’s important to be honest with yourself and acknowledge what needs to change.

Next, consider your options. Can you adjust your timeline for reaching your goals? Would it be helpful to seek professional advice? Are there expenses you can cut back on in order to free up more money for your financial goals?

Once you’ve identified what needs to change and considered your options, it’s time to update your financial plan. This might mean adjusting your budget, revising your savings goals, or changing your investment strategy. It’s important to be realistic and make changes that are feasible for your current circumstances.

Don’t be discouraged if you need to revise your financial plan - it’s a natural part of the process. The key is to stay flexible and willing to adapt to new situations. By doing so, you’ll be better equipped to reach your financial goals in the long run.

Seeking professional advice

While creating and managing your own financial plan can be empowering, there are times when it may be beneficial to seek professional advice. Financial advisors can offer guidance on everything from budgeting and saving to investing and retirement planning. Here are some situations where seeking professional advice may be especially helpful:

You’re unsure where to start: If you’re new to managing your finances or have a complex financial situation, it can be overwhelming to create a financial plan on your own. A financial advisor can help you get started and provide you with a clear roadmap for reaching your financial goals.

You’re dealing with a major life change: Whether you’re getting married, having a child, or facing a divorce, major life changes can have a significant impact on your finances. A financial advisor can help you navigate these changes and adjust your financial plan accordingly.

You’re nearing retirement: As you approach retirement, it’s important to ensure that you have enough savings to support yourself in your golden years. A financial advisor can help you create a retirement plan that takes into account your current assets, projected income, and desired lifestyle.

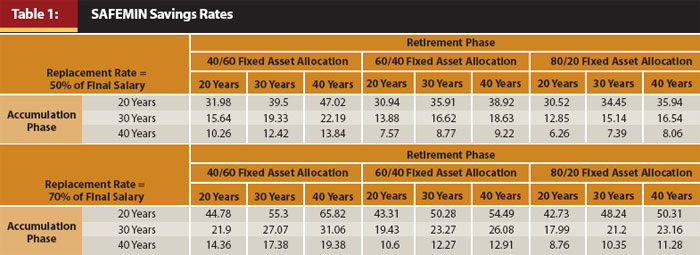

This table from the Pfau paper provides guidance on savings rates for accumulating adequate retirement savings

This table from the Pfau paper provides guidance on savings rates for accumulating adequate retirement savings

You want to optimize your investments: If you’re interested in investing but don’t know where to start, a financial advisor can help you create an investment strategy that aligns with your goals and risk tolerance.

You need accountability: Let’s face it - sticking to a financial plan can be challenging. A financial advisor can help hold you accountable and provide motivation to stay on track.

When seeking professional advice, it’s important to choose an advisor who is knowledgeable, experienced, and trustworthy. Look for advisors who are certified and have a fiduciary duty to act in your best interest. And don’t be afraid to ask questions and shop around to find an advisor who is the right fit for you. With the right advisor by your side, you can feel confident that you’re making informed financial decisions and working towards your goals.

Conclusion

In summary, the financial planning process involves several key steps, including setting goals, creating a budget, saving and investing, and monitoring and reviewing your progress. By following these steps, you can create a roadmap for achieving your financial goals and building a secure financial future.

The benefits of the financial planning process are numerous. By creating a financial plan, you can gain a better understanding of your financial situation, identify areas where you can save money, and develop strategies for achieving your long-term goals. You can also gain peace of mind knowing that you have a plan in place to weather unexpected financial challenges.

If you haven’t started the financial planning process yet, we encourage you to take the first step today. Whether you’re just starting out or are looking to take your financial plan to the next level, there’s no time like the present to begin building the financial future you deserve. With commitment and determination, you can achieve your financial goals and enjoy the many benefits of financial security.

FAQ

What is involved in the financial planning process?

- The financial planning process involves several key steps, including setting goals, creating a budget, saving and investing, and monitoring and reviewing your progress.

Why is financial planning important?

- Financial planning is important because it helps you gain a better understanding of your financial situation, identify areas where you can save money, and develop strategies for achieving your long-term goals. It can also provide peace of mind knowing that you have a plan in place to weather unexpected financial challenges.

When should I start the financial planning process?

- It’s never too early or too late to start the financial planning process. Whether you’re just starting out in your career or nearing retirement, creating a financial plan can help you achieve your goals and build a secure financial future.

Do I need to work with a financial advisor to create a financial plan?

- While working with a financial advisor can be helpful, it’s not necessary to create a financial plan. With some research and effort, you can create a financial plan on your own. However, if you have a complex financial situation or want personalized guidance, working with a financial advisor may be beneficial.

How often should I review and update my financial plan?

- It’s recommended to review and update your financial plan at least once a year. However, you should also review and update your plan anytime you experience a major life change, such as getting married or having a child, or when your financial situation changes significantly.