Welcome to the not-so-secret society of credit scores where the numbers you rack up can shape your financial destiny. Credit Scores 101 is not just a crash course; it’s your financial compass, guiding you through the murky waters of loans, mortgages, and those high-stakes money moves. In the grand game of life, your creditworthiness is like your hand of cards, and it’s time to learn how to play them right.

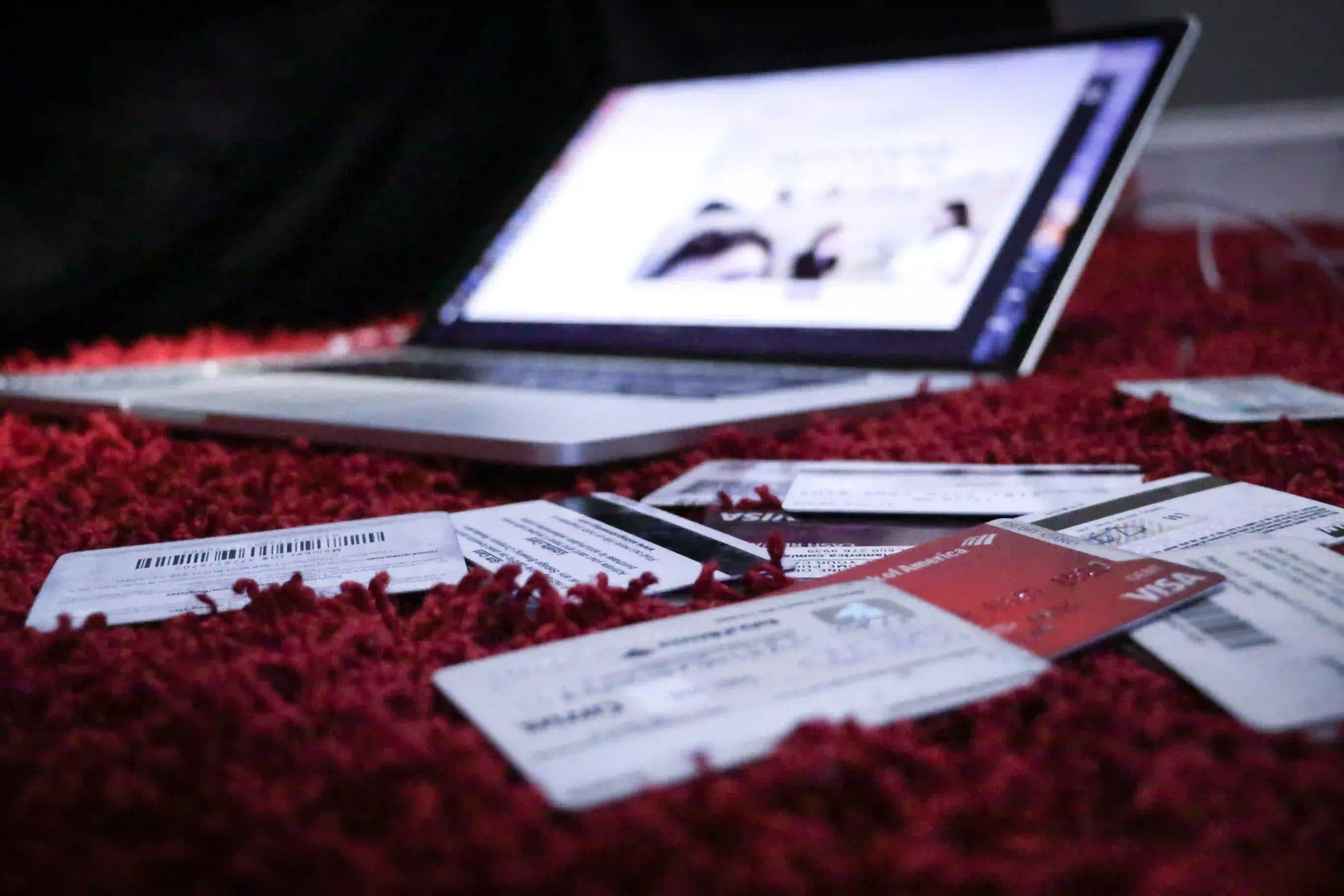

Diving into the world of credit scores might seem like peering into the abyss, but fear not—this blog post is your lifeline. Picture this: you’re eyeing that sleek car in the showroom, or maybe you’re dreaming of turning the key in the door of your own home. These aren’t just daydreams; they’re real-life goals that hinge on three digits that creditors hold dear. From snagging the keys to your new apartment to landing that personal loan with a smile, your credit score is the gatekeeper to your ambitions.

Brush up on your financial literacy with us as we slice through the jargon and lay out the facts with the precision of a Reuters report, all while keeping it as fresh and engaging as a VICE docu-story. We’ll unpack what makes up your credit score, why it’s the cornerstone of your financial health, and how you can give it a well-deserved boost. By the end of this, you’ll be ready to take the reins of your financial future and steer it towards a horizon of opportunity.

Stay tuned, because we’re about to lift the veil on the credit score enigma and set you up with some killer strategies to amp up your credit game. Whether you’re a financial newbie or a savvy spender, there’s always room to grow—and your creditworthiness is no exception. Let’s get to it, because those numbers aren’t going to climb themselves.

Section 1: The Basics of Credit Scores

What is a Credit Score?

Ever find yourself wondering why some folks breeze through the gates of financial freedom while others get bogged down at the toll booth? The answer often lies in that mystical three-digit number known as a credit score. This bad boy is the financial world’s open secret, a numerical representation of your creditworthiness that lenders use to judge whether you’re as reliable as a sunrise or a dice roll away from financial chaos.

To get to the nitty-gritty, your credit score is calculated based on a mix of ingredients that would make even a master chef sweat. We’re talking about factors like payment history—do you pay your bills on time like clockwork? Then there’s credit utilization, or how much of your available credit you’re using at any given moment. Think of it like your financial waistline—overindulge, and it’s not just your jeans that’ll be tight. Don’t forget the length of credit history; it’s like a fine wine, the longer, the better. And these are just the appetizers.

Understanding the components that shape your credit score is like being handed the playbook before a big game. You’ll know which moves can hike up your score, like paying bills punctually or keeping credit card balances low, and which ones to avoid, lest you ding your credit rep. By weaving in these savvy habits into your financial routine, you’ll be on your way to boosting that score and unlocking the door to better loan terms, lower interest rates, and the sweet, sweet air of financial confidence.

Why is Creditworthiness Important?

Imagine walking into a bank with the swagger of someone who knows they’ve got it all together, financially speaking. That’s the kind of confidence a solid credit score can bring. Creditworthiness isn’t just a random number—it’s a snapshot of your financial trustworthiness, and believe us, it’s as crucial as your Instagram followers are for your social cred.

Having a good credit score is like having a VIP pass to the financial world. It can snag you lower interest rates on loans, which means those dollars stay in your pocket rather than padding the bank’s profits. Think about it: a lower interest rate on your auto loan could save enough cash for that road trip you’ve been dreaming of. And when it comes to bigger dreams, like owning a home, your credit score can be the deciding factor between a ‘yes’ and a ’no’ on a mortgage application.

But the impact of your creditworthiness doesn’t stop at borrowing. It can affect your apartment rental applications, your insurance premiums, and even your job prospects. In a world where your financial moves are constantly scrutinized, a good credit score is your best defense—and offense. Let’s dive into some real-life scenarios where creditworthiness plays the lead role:

- Securing a Mortgage: Jane Doe thought her dream home was out of reach until her excellent credit score convinced lenders she was a risk worth taking.

- Renting an Apartment: John Smith was able to skip the hefty security deposit and move into his loft downtown, all thanks to his solid credit history.

- Landing a Job: Alex Johnson didn’t realize that her credit score would come into play during her job hunt, but it turned out to be the ace up her sleeve in a competitive market.

In each scenario, creditworthiness isn’t just a number—it’s a character reference, a badge of honor, and a key that unlocks doors. It’s time we stop treating our credit scores as afterthoughts and start nurturing them like the powerful tools they are. Stay tuned as we crack the code on building and maintaining creditworthiness. Your financial freedom might just depend on it.

How to Check Your Credit Score

Think of your credit score as your financial fingerprint—it’s a unique identifier of your creditworthiness and every financial move you make can impact it. Getting to know your credit score is like looking in a financial mirror, giving you a clear reflection of your fiscal health. So, how do you sneak a peek at this magic number?

Checking your credit score is easier than you might think. A plethora of online services and credit bureaus are ready to serve up your score with a few clicks. Many of these services are free and user-friendly, offering a detailed look at your credit without dinging your score. You can expect to get your hands on the big three digits from firms like Equifax, Experian, and TransUnion, which are the main credit reporting agencies.

What’s more, once you’ve got your score, you’ll also get a credit report—a dossier that spills the beans on your credit history. It’s like a report card showing where you’ve aced it and where you’ve, well, could do better. And here’s a pro tip: scrutinize your credit report for any inaccuracies or old debts that should’ve been wiped clean. Spotting errors and getting them fixed can give your credit score a boost—think of it as credit score first aid.

But don’t just check your score and forget about it. Regular monitoring is crucial. It’s like keeping an eye on your bank account; you want to catch any suspicious activity before it spirals. By keeping close tabs on your credit score, you can also see the impact of your financial actions, from the aftermath of a shopping spree to the benefits of consistent, on-time bill payments.

Remember, your credit score is more than just a number—it’s a gateway to financial opportunities. A good score can unlock doors to loans, mortgages, and even better interest rates, so staying informed and proactive is the name of the game. Keep your finger on the pulse of your financial health, and you’ll be ready to make moves that count.

Strategies for Improving Your Creditworthiness

Paying Bills on Time

Picture this: It’s a casual Tuesday evening, and as you’re about to dive into that gripping final episode of your latest binge-watch, a nagging thought creeps into your mind — Did I pay my credit card bill? It’s in these seemingly trivial moments of forgetfulness that your credit score, that all-important number dictating your financial street cred, can take an unnecessary hit. Your payment history is the heavyweight champion when it comes to credit score factors, throwing the most significant punches in determining your creditworthiness.

Not paying bills on time is like being the main character in a horror movie who keeps tripping over nothing — it’s avoidable and just plain bad for your survival. To steer clear of financial faceplants, let’s hash out some real-talk tips. Get yourself a digital calendar that pings you with reminders, automate those payments if you can, and maybe even buddy up with a friend for a bill-pay date. Yeah, you heard that right. Make it social (and a bit competitive, perhaps?) to ensure those bills don’t slip your mind.

By turning bill payments into a non-negotiable ritual, like your morning cup of joe or that nightly skincare regimen, you can help your credit score blossom. It’s not just about avoiding nasty late fees; it’s about showing lenders that you’re as reliable as that one friend who always remembers birthdays. Every on-time payment is a small victory parade for your credit report, and believe us, those parades add up to a credit score that opens doors — literally, like the front door to your new home. Keep it consistent, and watch your creditworthiness climb like it’s on a personal mission to reach the top.

Managing Credit Utilization

Imagine your credit utilization as the fuel gauge on your financial dashboard — you don’t want to be running on empty, but you definitely don’t need to be gunning it at full tank 24/7 either. Credit utilization is that sweet spot; it’s the ratio that screams “I’ve got this” to potential lenders, showing them just how smoothly you handle your financial ride.

So, what’s the magic number? Experts tend to agree that keeping your credit utilization below 30% is the ticket to a shiny credit score. Not too high to signal distress, and not too low to indicate inactivity. It’s like the Goldilocks zone for your credit card balances.

Now, let’s talk strategy. To keep your credit utilization in check:

- Monitor your balances like a hawk. Stay vigilant, my friends.

- Set up balance alerts because who doesn’t like a heads-up?

- Pay down your balances more than once a month. Show ’em that you’re not just reliable, you’re ahead of the game.

- Request a credit limit increase, but only if you can trust yourself not to splurge. More room to breathe on your credit limit means a lower utilization ratio, as long as you don’t load up on extra debt like it’s Black Friday every day.

By keeping your credit utilization low, you’re not just flexing your financial responsibility muscles; you’re actively beefing up your creditworthiness. And in this world, a robust credit score can be your VIP pass to better interest rates, sweeter loan terms, and that nod of approval from lenders when you need it most. Keep it responsible, keep it savvy, and watch your credit score climb like it’s got a rocket strapped to its back. 🚀

Building a Strong Credit History

When it comes to the world of credit, time is your ally. The length of credit history can be a game-changer in the eyes of lenders, painting a picture of reliability that’s as vivid as street art on a Brooklyn warehouse. Just like a fine wine or a classic vinyl collection, the value of your credit history grows with age. So, let’s dive into the no-nonsense tactics for nurturing a credit report that glows with financial maturity.

Starting from Scratch can feel like you’re the new kid on the financial block, but don’t sweat it—we’ve got the roadmap to help you lay down those first crucial layers of credit paint. If you’ve got family with a credit card history as rich as a Basquiat painting, becoming an authorized user on their account could be your backstage pass to credit score stardom. You’ll bask in the glow of their good credit habits, as long as they’re as consistent as a metronome.

But hey, maybe you’re the lone wolf type, building your empire solo. In that case, a secured credit card is your brick and mortar. With this card, you put down a cash deposit that becomes your credit limit. It’s a safety net for both you and the lender—like training wheels for your credit score. Show ‘em you can ride without a wobble by making payments on time, and soon enough, you’ll be doing wheelies.

Remember, these steps for establishing a solid credit foundation are just the beginning. Each timely payment is a brush stroke on your masterpiece. Keep it consistent, and before you know it, you’ll have a credit history as robust and dependable as the graffiti that’s been on the corner deli for a decade—impossible to ignore and evidencing a story of dedication and persistence.

Common Credit Score Myths Debunked

Closing Credit Cards Improves Your Credit Score

Let’s bust some myths, shall we? It’s time to tackle that persistent rumor floating around the financial watering holes: the idea that giving your credit card the chop is some sort of credit score hack. Spoiler alert: it’s not. In fact, waving goodbye to your plastic pals may actually backfire when it comes to your creditworthiness.

Here’s the deal: your credit score is a complex beast, influenced by a cocktail of factors including credit utilization, length of credit history, and the diversity of your accounts, among others. When you shut down a credit card, you’re not just cutting off a piece of plastic; you’re potentially dinging your credit utilization ratio. That’s the balance you owe compared to your total credit limit, and trust us, you want to keep that ratio as low as possible.

But wait, there’s more. Closing an account can also shorten your credit history, which is like wiping out the evidence of your financial maturity. Not exactly the move you want to make when you’re trying to prove you’re creditworthy.

So, what’s a savvy credit user to do? Before you snip that card, think strategy. Maybe keep that old card with the solid history tucked in a drawer for occasional use. Keep those balances low and pay them off like a boss. There’s no quick fix or magic bullet, but with smart management and a bit of patience, your credit score can become a point of pride.

Remember, folks, in the world of credit scores, knowledge is power—and now you’ve got some. Keep those cards open, keep ’em balanced, and watch your credit score thank you for it.

Checking Your Credit Score Lowers It: Busting the Myth

Ever heard that peeking at your own credit score is like poking a sleeping bear? That it’ll wake up and maul your creditworthiness with a vengeance? Well, let’s bust that myth with the fervor of someone who’s found out the boogeyman is just a pile of coats on a chair. When you check your credit score, what you’re triggering is what’s known as a soft inquiry. Unlike its burlier cousin, the hard inquiry, this one tiptoes around your credit report, leaving it as pristine as it found it.

Soft inquiries are the background checks of the credit world; they’re just you or a company sneakily checking your financial street cred without the intention of borrowing. They’re like a credit score selfie: no harm, no foul. In contrast, hard inquiries are the real deal. These happen when you apply for a loan or a credit card, and yes, they can ding your score a little. It’s like the universe saying, “Want to borrow some cash? Prove you’re worthy.”

But here’s the kicker: monitoring your credit score regularly is not just safe; it’s smart. It’s like having a map to hidden treasure, except the treasure is your financial reputation. Staying on top of your score means you can:

- Catch errors faster than a fact-checker on deadline day.

- Spot identity theft while it’s still just a wannabe thief.

- Get a read on your credit health, so you can flex those financial muscles or nurse them back to health.

In the great game of credit, knowledge is power. And checking your score? That’s just leveling up. So, don’t let the myth keep you from keeping an eye on your fiscal scorecard; your creditworthiness depends on it.

Closing Old Accounts Removes Them from Your Credit Report

Think you can just shut down that old credit card and it’ll vanish into thin air, scrubbed from your credit history like a bad tattoo with a laser? Nope, that’s not how it goes down in the credit world. Here’s the real talk: closing old accounts doesn’t erase them from your credit report. It’s a common misconception that could mess with your mojo if you’re trying to be the master of your credit domain.

Keeping those old accounts open is like holding onto a vintage wine—it gets better with age and shows you’ve got history. Your credit score digs that kind of long-term commitment, and it rewards you for it by taking into account the length of your credit history. It’s a crucial part of your financial story, telling lenders you’ve been in the game for a while, which can make you look pretty appealing in their eyes.

But let’s slice and dice this further: when you close out old accounts, you’re also messing with your credit utilization ratio—that’s the amount of credit you’re using compared to what’s available to you. Close an account, and suddenly, you’ve got less credit at your fingertips, which can make your utilization ratio spike. And just like double-dipping your chip at a party, that’s a major faux pas in the credit score world.

Bottom line: those old accounts could be your silent allies, making your credit report look robust and your creditworthiness shine. So, think twice before you give them the chop. Keep them open, keep your utilization low, and keep your credit score climbing like it’s on a rock-star tour to the top.

Conclusion: Mastering Your Creditworthiness

As we wrap up our deep dive into the world of credit scores, it’s clear that these little three-digit numbers pack a hefty punch in the financial ring. Your credit score is like the heartbeat of your financial health—constantly pulsing in the background, influencing lenders’ perceptions of your creditworthiness. Throughout this blog post, you’ve become savvy about what makes your credit score tick and, most importantly, how you can give it a healthy boost.

Regularly checking your credit score isn’t just a good habit; it’s a crucial check-in on your financial reputation. Think of it as a self-care routine for your wallet—necessary and enlightening. By keeping a close eye on it, you can catch any discrepancies early and maintain your financial integrity.

Improving your credit score is not an overnight success story but a tale of persistence and financial wisdom. Embrace the challenge; make payments on time, keep your balances low, and don’t shy away from seeking credit advice. These actions are your stepping stones to a robust financial profile.

Remember, folks, creditworthiness is not a fixed state. It’s a dynamic journey that continually evolves with your financial decisions. It’s about playing the long game—making moves that set you up for a future where financial doors swing open with ease.

Start your journey today—because when it comes to unlocking the doors to financial opportunities, the power is in your hands. Don’t wait for a better credit score to come knocking; it’s time to build it, one responsible choice at a time. Embrace the journey, and let’s turn those credit score blues into a triumphant financial anthem.